Starlink for transatlantic travel

For Starlink to become profitable, it is crucially important to rollout the service to wide areas of Earth, since this lowers the average cost of space segment per subscriber significantly. Covering just the area of continental US represents 3% of the total Starlink coverage. Which means (in the long run) just 3% of total addressable market.

Addressing other populated areas in other countries is not a technical challenge, but SpaceX will face big issues with licensing. No wonder that are addressing English speaking countries first, which are also close allies of the United States: Canada, Australia, New Zealand. That almost doubles the addressable market.

But access to other markets will be highly contested, even in EU. Although Starlink will be technically able to reach majority of rural population in the world, it will face a stiff opposition and roadblocks.

So what are the easiest picking fruit for Starlink after large land-masses of US allies? I would suggest maritime and airline market, especially in the Caribbean and North Atlantic.

As COVID-19 causes death toll extending millions, causing major disruptions in hospitality, entertainment, tourism and travel industries, it might seem foolish to suggest that broadband Internet in passenger airplanes as major opportunity for Starlink. It has fancy name - in-flight connectivity (IFC), and was projected to grow from five billon in 2018 to 7.65 billion in 2023. Or even 36 billion by the end of the decade. Of course, COVID-19 has put such plans under a big question. But IFC in the current form suffers from the same issues as any satellite broadband: huge latency and limited bandwidth. Let us not forget high prices, too. Complex business model. High terminal cost (estimated between 200,000 and 300,000 USD per aircraft in 2013). No wonder that IFC was slow to pick up. There is obvious customer expectation of having fast Internet everywhere and anywhere.

Starlink is trying to be just that - predictable, high performance Internet access available anytime everywhere. With easy, simple to understand business model. Other major players seem to rely on high throughput satellites (HTS) as the main technical backbone for IFC. But if Viasat and HughesNet are such disappointment for rural subscribers, why would they be any better for IFC?

Long term Starlink will support inter-satellite links (ISL, another nice TLA, which stands for Three-Letter-Acronym). It will make it easy to route traffic from any place over the ocean back to the nearest gateway. But it will take years to complete such a constellation and gateways. So it is not realistic to count on lasers in operational network before 2025. The question is how could the current generation of satellites be used to address this market without this advanced feature.

One problem is custom aircraft terminal, as existing terminal is not suitable for the airplanes. Such terminal will probably be significantly more expensive since it will need to provide a "true" 2D phased array antenna. Starlink was already tested by US Air Force, so aircraft terminals have been in design stage for some time now.

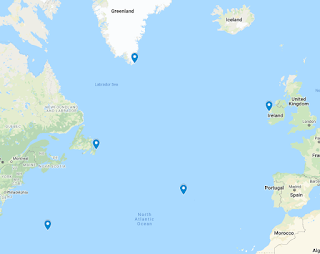

While flying over or near the continental land masses aircrafts would compete for the same bandwidth with land based subscribers, but over oceans there would be no "competition". But there can be no gateways in the ocean, too. However, Starlink gateways can be easily positioned on Newfoundland, southern tip of Greenland (although it is at 60deg latitude), Ireland, Bermuda and Azores. If you look at the map, no aircraft would be further than a 1300km from the nearest gateway.

Interestingly, the suggested locations do have fiber-optic submarine cable landing stations near by.

|

| Transatlantic submarine cables |

As average distance from Ireland to Newfoundland is around 3200km, it might seem that gateways would be placed too far away from each other. Note that the connecting satellite is essentially a network node that is located BETWEEN the gateway and the airplane. Using possible angles up to 35 degrees leads to maximum distance between aircraft and satellite of 900km (projected to the ground). Assuming the same allowed angle of 35 degrees between satellite and the gateway antenna, that gives another 900km of reach in ideal conditions (where satellite is exactly between the aircraft and the gateway). Since the distance between satellites is 600km or less for the initial constellation size, we can notice that Starlink can provide over 90% coverage of typical transatlantic route. Even without inter-satellite links. Or buoys/ships/floating platforms in the middle of the ocean.

But is gets better. There are three reasons why the angle between a satellite and ground station is limited to 35 degrees. First is related to atmospheric attenuation. Lower the angle, more attenuation happens since the signal must travel through more air. But aircraft will spend most of the time above 3/4 of the atmosphere. And above the clouds. The second reason is signal power (larger distance), but this can be easily addressed with higher power and larger antenna. And the third reason is related to beam forming limitation of the phased array antenna, especially on the satellite. These antennas will be pointed straight to the surface when flying over the continents. But over the oceans, Satellite can be tilted to adjust its ellipsoid coverage area to address the middle of the North Atlantic better. That should extend their reach significantly.

If the coverage "hole" in the middle of the ocean is a problem, SpaceX has great experience with three operational autonomous spaceport drone ships, used for rocket booster landings. And fourth is under construction. At the same time, FCC was asked to provide license for testing ten terminals on their maritime vessels, including the ASDS platform.

How much it would cost? Brand new 300 feet long barge, made in China costs around three million USD. There are many necessary upgrades, link station keeping engines, extended fuel tanks suitable for long operations etc. But still, how much it would cost? Three times as much? For just 10 million and a single ASDS, Starlink could provide coverage of complete North Atlantic.

Why is this important? It illustrates capability of Starlink, even in its basic form, to address the most frequent long haul route - transatlantic route. In its peak before the pandemic, this route was responsible for 5% of total world air travel. In 2019, there were over 85 million passengers crossing the Atlantic, utilizing over 1700 daily flights.

Sure, it will take time to recover from the current pandemic. But in the new world, how many passengers will want to fly without Internet connection? Or pay premium for it? Existing IFC providers (like Gogo 2KU offering) might require shady business practice to extract recurring revenue from passengers. And it will lack bandwidth, low latency. And how much does 2KU terminal refitting cost? Numbers are hard to find, but one estimate from the early days of IFC put it to 200,000 to 300,000 USD per aircraft. That is big cost that has hampered the progress of universal in-flight connectivity. With user terminal that cost 500 dollars, could SpaceX do better? After all, they are in the aerospace business. What if they could design aircraft terminals (with installation) for 20.000USD? Charging average 200 passengers per plane additional 10USD for high performance Internet connectivity? Return of the investment in TEN days. Not years. Not months. Not even weeks. Days. With just five gateways? And no additional investment in the space segment?

Such solution would wipe out the competition, as long haul flight is the most popular application for in-flight connectivity. Lets say the yearly addressable market is just half of the transatlantic passengers. 40 million. And it requires 2000 aircraft terminals. That would be 40 million one time investment. Cost similar to a single Starlink launch. Airlines get the refitting for free. Maybe even add free data telemetry as a bonus. In return, SpaceX would get 400 million revenue per year with a minimal additional investment. Without futuristic lasers. Compared to investments for satellite manufacturing, terminal manufacturing, launch, that is a minor investment. Even additional ASDS repurposed for the gateway duty would be minor investment.

A real question here is whether SpaceX could reduce terminal production and installation cost ten-fold compared to the competition. That is a big task. Tesla managed (or at least influenced) to do that with batteries. SpaceX managed to do that with Falcon 9 (well, it depends what is taken as a measure, here, it is closer to 2x-4x improvement). And again with Starlink satellite production (4x per kg improvement compared to OneWeb satellites, 10x improvement to typical GEO satellite). And again with Starlink user terminal and its phased array antenna (500USD one time vs 995USD per month for Kymeta). Why should aircraft terminals be any different?

Comments

Post a Comment